|

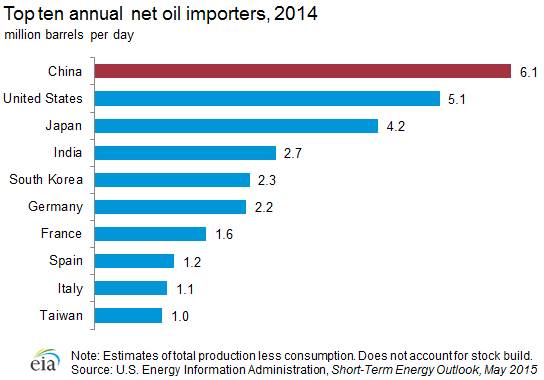

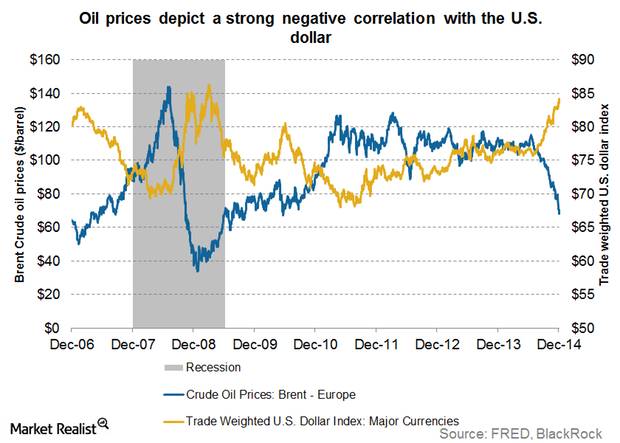

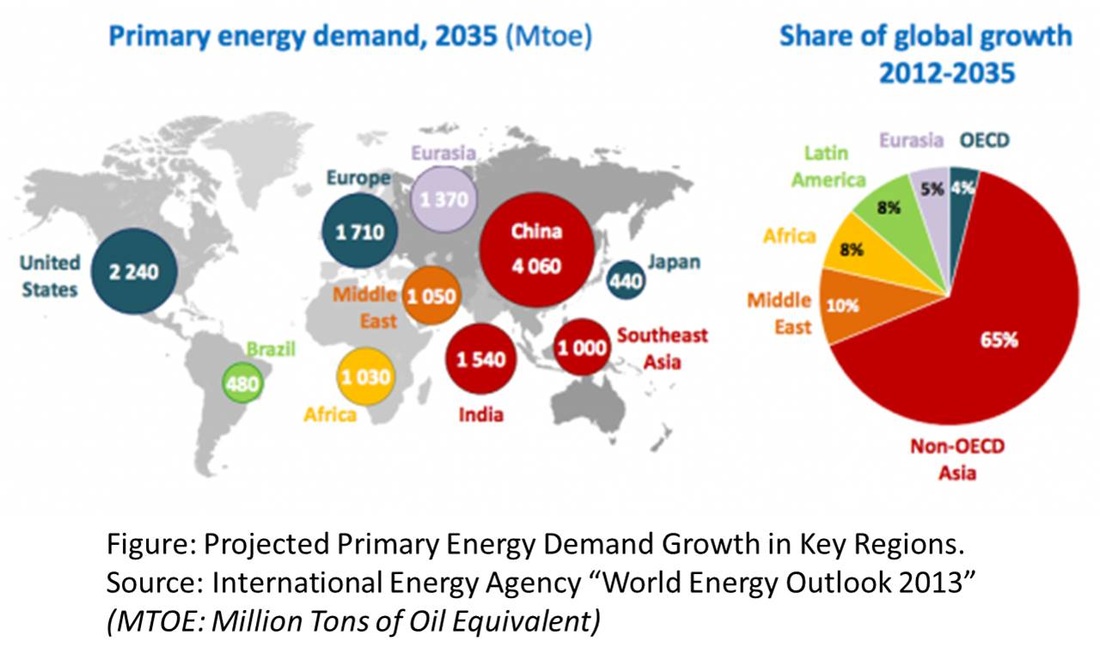

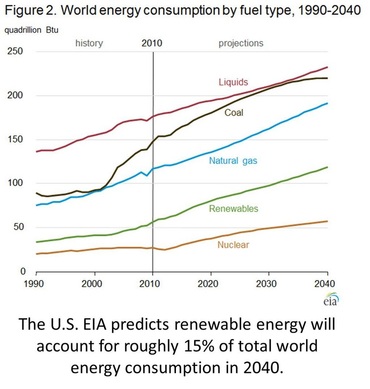

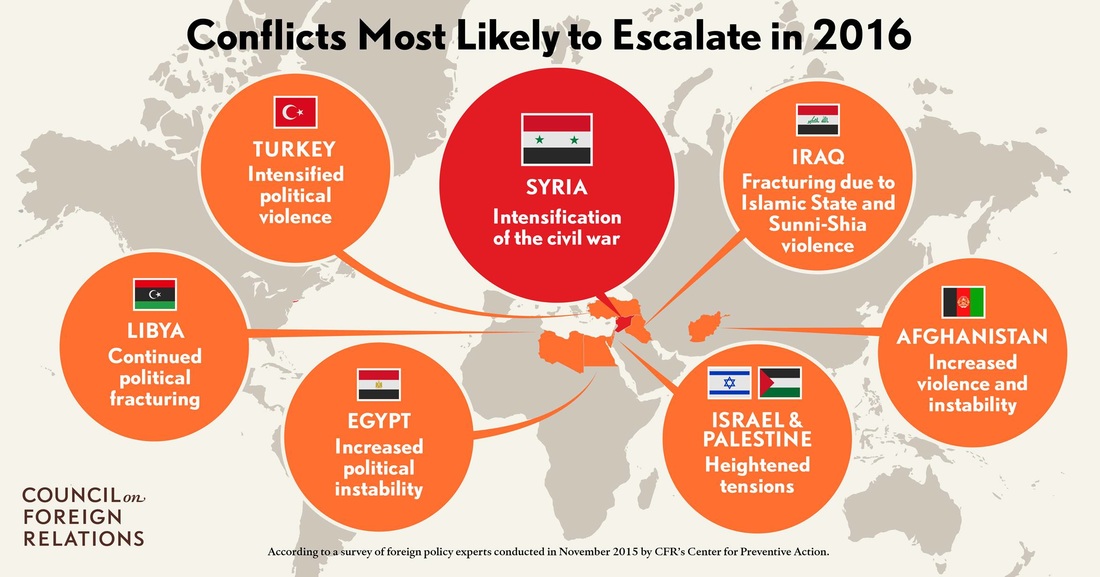

By Andrew C. Katen “There will be a time when you believe everything is finished. That will be the beginning.” – Louis L’Amour “The age of oil is coming to an end,” repeated Mr. Girard, looking very somber in his tie, pressed shirt, and wire-rimmed glasses. He had just wrapped up a lecture about the future of the world economy . Now he sat on the corner of a student’s desk with his arms crossed over his chest. Loosening his tie with one hand, his eyes scanned the room of freshman history students for questions or comments. Aside from the clink of Jeff Hamilton’s pencil hitting the floor in the third row, the room was silent. After a long pause, Mr. Girard sighed and added, “In the last two years, oil prices have dropped from over 100 dollars a barrel to 30 dollars. This proves the world no longer needs or wants oil. We are moving away from our dependence on fossil fuels.” After another pause, he asked, “Well? What do you think?” Sitting in the back row, next to the windows, Patrick Eaton doodled in his notebook. As he sketched a landscape of mountains and deserts – his mind seemingly far away from the discussion at hand – it suddenly occurred to him that he might look bored. As Mr. Girard cast an eye over the class, no doubt making mental notes for assigning participation grades, Patrick realized that he might have already earned a zero for his apparent indifference. In reality, Patrick had reflected upon every word spoken during the past forty-five minutes. As he doodled, he was actually trying to summon the courage to share his own views in front of thirty of his peers. Ultimately, however, Patrick decided to keep quiet. After all, what was the point? Mr. Girard was no fan of fossil fuels. He had made this perfectly clear at the beginning of the school year when Patrick shared that his dad was a petroleum geologist, and that they had spent the previous summer looking at oil and gas prospects in Central Asia. Since Patrick’s grade in the class was hovering around a B-minus, the last thing he needed was to provoke Mr. Girard into adding another C to his report card. In these situations, he knew from experience, it was often better to keep his eyes and ears open and his mouth shut. As Mr. Girard began passing out worksheets, Patrick’s thoughts drifted back to the previous weekend, when his family had attended a barbecue hosted by his dad’s boss, Skip. Patrick had come to know and like this loud, gregarious Texan years ago. Last summer, during their adventure across Central Asia, the two had grown even closer. Patrick had discovered that Skip was not just funny and smart, but also attentive to Patrick’s intense hunger for knowledge. Even though Skip was a busy manager of an oil company, he always found time to address Patrick’s questions. “Let’s talk level,” Skip would answer in his Texan twang, as if he and Patrick were colleagues. After the barbecue dinner, as dusk settled in and the crickets began their nightly symphony, Skip, Dad, and Patrick had wandered from the crowded patio of Skip’s home to the fire pit at the back of his property. Relaxing next to his dad on a log, Patrick watched Skip poke the crackling fire with a cattle iron as his other hand faithfully clutched an icy drink. When the Texan finally settled into a camp chair, resting one cowboy boot against a log and his straw cowboy hat on his knee, Patrick prepared himself for a dose of “level talk.” He didn’t have to wait long. “It’s getting ugly out there, fellas,” Skip growled as he stared into the flames. “With oil prices this low, our company is gonna have to rein in some of our operations. And you know what that means…” Dad nodded without looking up. “Layoffs,” he answered, almost whispering. “We’ll have to cut a lot of employees.” “Yep. It’s a nasty bit of business… and nobody’s job is safe.” Patrick thought he detected Skip’s eyes dart to his dad, but in the flickering light of the campfire perhaps it had only been an illusion. “What going on?” Patrick asked, surprised by the turn in conversation after what had seemed like such a festive dinner. He tried to ignore the butterflies forming in his stomach. Surely, this drop in prices wouldn’t affect his dad’s job. “Well, partner, the oil market is in the gutter,” Skip drawled, taking a sip from his glass as he swatted at a mosquito. “Happens from time to time. Oil prices are notorious for going up and down. It’s a crazy business. Price swings can wreak havoc on company finances and world markets… and my old ticker, too.” He managed a weak smile. For what seemed like a full minute, nobody said anything. But Patrick could hardly contain his curiosity. Although he rarely spoke in Mr. Girard’s class, Patrick couldn't resist the urge to ask questions when he was around Skip. “But last summer, you said fossil fuels provide most of the world’s energy…” Patrick probed. “I thought oil and gas was going to be around for a long time.” Skip chuckled, lightening the mood a bit. “Well, that’s still true. Oil and gas aren’t going away. While there are a lot of people claiming the oil industry is done with, it’s important to keep in mind the wider perspective.” Skip sat up and reached for the iron rod. Leaning over his knees, he drew a large “X” in the dirt, and then stared intently at his creation. “Supply and demand,” he said, as if to himself, still looking at the ground. “That’s what drives prices up or down in any industry. Simply put, when the supply of something goes up, the price goes down.” He traced one line of the “X” with the cattle prod, and then pointed at the other line. “When the demand for something goes down, the price goes down. Right now, the supply of oil is up and the demand is down. Put these factors together, and you get low oil prices.” Last summer, Patrick had talked with a lot of people about oil and gas, geopolitics, and the history of Central Asia. Though Dad had often been nearby, he had seldom joined in, as if he wanted to give his son the chance to develop his own perspectives. Tonight, he remained characteristically quiet, staring at the fire as he cupped his own icy drink. “Why is the oil supply so high right now?” Patrick asked. Skip tossed the ice from his drink into the fire and thumped his cowboy hat back onto his head. This was going to get serious, Patrick thought. “Well, there’re lots of reasons. For one thing, oil prices were over 100 dollars a barrel a few years ago. Whenever prices go up – especially that high – it becomes more profitable to drill for oil. And with high prices, a lot of companies signed contracts to provide oil to their customers. Even though prices are lower now, we still have to fulfill these obligations, even if it’s not as profitable for us.” Skip looked at Patrick for several seconds, waiting for his words to sink in. “Then there’s politics, of course,” he added. “Remember when I said that whoever controls the energy controls the world?” Patrick nodded, recalling their discussion in Baku. Over the course of the previous summer, Patrick had learned a lot about the political aspects of the energy industry from Skip, as well as from others he had met along the Silk Road. Skip continued: “Right now there seems to be a price war being waged among producers. Everybody is cranking out as much oil as they can to drive prices all the way to the bottom. The idea is to knock competitors out of the market. It’s like the game of ‘chicken’ – nobody wants to be the first to swerve. But at some point, folks will begin to jump ship. Oil producers that can’t survive basement-level prices will go out of business.” “All right, so there’s a huge supply of oil available,” Patrick summarized aloud. “But why is demand falling? You said that less people are buying oil, too.” Skip nodded vigorously. “Yep, over the past few decades the world’s economy has grown a lot. China has been a leader of this growth. For years, Chinese factories cranked out all sorts of products, which they sold to the entire world. China’s population has increased dramatically, too. Taken together, the country has become the world’s biggest importer of oil. But now its economy has slowed – and nobody knows what will happen next. Maybe things pick up again, or maybe they will get worse. Whatever happens to China will affect overall demand for oil – and the resulting price.” Muffled laughter from across the grassy lawn turned their heads momentarily. When a log rolled out of the circle of rocks, their attention returned to the fire. With the toe of his boot, Skip casually flipped it back into the flames. “Then there’s the value of the dollar,” the Texan continued. “Historically, the price of oil and the value of the dollar have had an inverse relationship. That is, they are opposites. When the dollar is strong (meaning you can buy more stuff with it), oil prices are low. When the dollar is weak (meaning it buys less stuff), oil prices are high. It’s been this way for decades. Right now, the dollar is strong.” “So, has this ever happened before?” Patrick asked. “You said oil prices go up and down, but have they ever been this low?” “Oh, yeah, absolutely,” Skip answered, pushing his hat back on his head. “When you look at oil prices over the past 100 years, today’s prices are not that unusual. Sometimes prices go down, but they have always gone back up. In any case, the fundamental role of fossil fuels in the world economy has not changed. Energy moves the world…” “And the world never stops,” piped in Dad, shifting his weight on the log. Turning towards Patrick, he added, “The overall trend in the world has been increasing populations and rising standards of living. Every year, there are more people, and they are living longer. More people than ever want electricity, cars, and the internet. They are hungry for the luxuries that we Americans take for granted.” “Think of it this way,” Skip interjected. “If the internet was a country, it would be one of the world’s five largest consumers of power. That’s how much energy is needed just to keep the internet going. And with lower oil prices, gasoline becomes cheaper, too, meaning more people can afford to drive cars and use electricity. Lower prices lead to higher consumption of oil.” “But what about renewable energy?” Patrick countered. “Mr. Girard says solar and wind power will make fossil fuels irrelevant.” “I hope so,” Skip replied, leaning back in his chair. Patrick was surprised to hear this from an oil and gas professional. “Honestly, I do. If someday my grandkids can get all their energy from the sun or wind, all without producing a drip of pollution, that’d be fantastic. But let me tell you something – even the most optimistic predictions agree that renewable energy will only provide 15% of the world’s energy by 2040. And with today’s oil prices being so low, renewable energy is more expensive today than it ever has been.” “So, what would cause the price of oil to go up again?” Patrick asked. “Supply and demand,” Skip stated matter-of-factly. “Low oil prices will force oil companies to cut production. The result is that less oil will be available a year or two from now. As I already pointed out, a reduction in supply tends to drive prices up. When the economy eventually improves, demand will also increase, causing the price of oil to go up. And then there’s the U.S. dollar. If it loses value – which, by the way, it has been doing over the past hundred years – the price of oil will go up.” “And what about politics?” Patrick asked. “Could that drive the oil price back up?” “Absolutely,” Skip boomed. “The collapse of oil prices actually creates a dangerous political situation. Many governments around the world are dependent on oil profits for their survival. Some are extremely corrupt and not particularly liked by their citizens. Known as ‘petro-dictatorships,’ these regimes may be hanging onto power by a thread. Without the billions of dollars that oil profits bring in every year, these governments won’t be able to pay for the projects that keep their citizens from revolting and overthrowing them. Political upheaval in any of these oil-producing countries would not only reduce the world’s oil supply, it would also scare the pants out of the stock markets. Just the fear created by such an event could blow oil prices sky high.” “And then there’s terrorism,” Dad added. “An attack against an oil facility by a group like ISIS or al-Qaeda – or the takeover of oil fields by insurgents – could send oil prices through the roof.” “Absolutely,” Skip agreed. “And there are plenty of other geopolitical risks, too. Maybe Russia cuts off its gas supply to Europe? Or perhaps Iran and Saudi Arabia go to war? Or the next U.S. president decides he wants to bomb Iran? And then there’s the risk of nationalism – suppose one of these petro-dictatorships decides to seize the private oil companies operating within its borders? Yep, there are plenty of geopolitical powder kegs around the world. Take your pick – any one of them could go off and drive up the price of oil.” “So what happens now?” Patrick asked, looking from Skip to his dad, and then back to Skip. The Texan took a deep breath, pushed back his hat again, and let out a sigh. “Good question, partner. For now, we batten down the hatches and prepare for nasty weather. Until oil prices recover, we do what we have to in order to stay afloat. This means capping wells, closing offices, and letting go of employees… even good friends.” This time Patrick was certain that he saw Skip glance at his father. But before Patrick could speak, Dad stood up, stretched his legs, and put a hand on Patrick’s shoulder. “Well, buddy, that’s a lot to think about for now. It’s getting late, and we better hit the road.” Strolling back across the dew-covered lawn, with his dad’s arm around his shoulder, Patrick was unsure what he had just heard, let alone how he felt about it. As fireflies flashed all around them, and the laughter, clinking of glass, and mouthwatering aroma of barbecue reached them from the porch, Patrick felt as if he were in a dream. While he couldn’t be certain, something told him the ground was shifting under his feet. When he spotted the look on his mother’s face as her eyes met his dad's, Patrick knew he was right. Their lives were about to change. Remembering the advice uttered so often by his grandpa, Patrick made an effort to stay positive. Fighting back the sting in his eyes, he took a deep breath, managed a smile for his mom, and tried to imagine what new and exciting adventure awaited the Eatons. ©2016 Andrew C. Katen. All rights reserved.

Permission is granted to share this article with others, as well as to print or post it on other websites, so long as credit is given to the author.

1 Comment

|

AuthorAndrew C. Katen Archives

November 2016

Categories

|

RSS Feed

RSS Feed